While the term “Africa To The World ” is increasingly becoming a global phenom amongst African creatives, the dynamic world of venture capital seems to be getting its fair share.

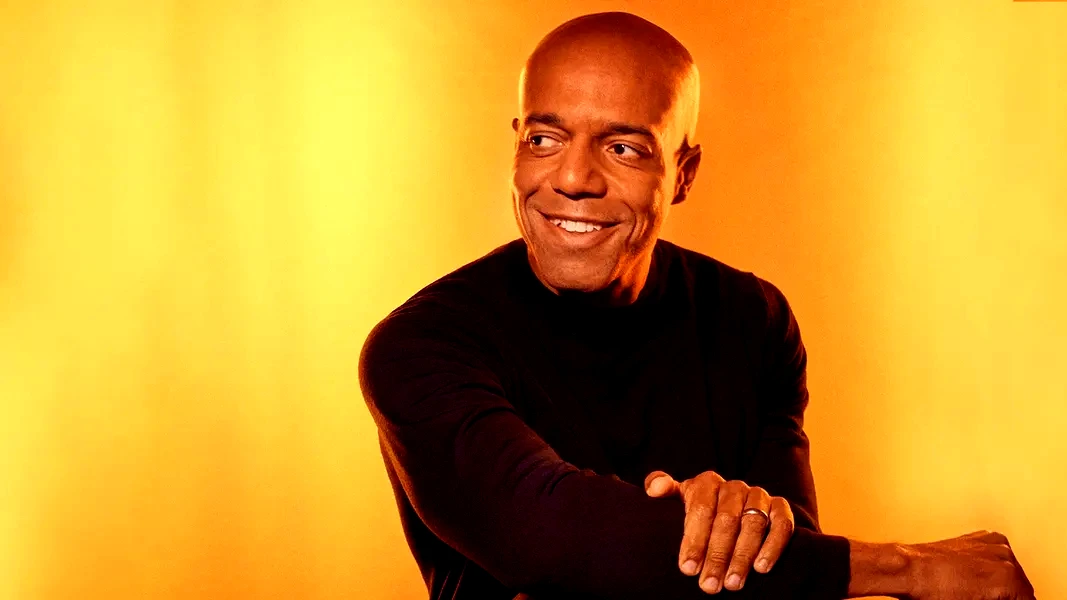

One of such stories is that of Adeyemi Ajao, co-founder and managing partner of Base10 Partners. As the first Black-led venture capital firm to surpass $1 billion in assets under management, Base10 Partners is reshaping the investment landscape by focusing on technology startups that offer practical solutions for everyday people. Ajao’s journey from a self-taught coder in high school to a leading figure in global venture capital is a testament to his visionary approach and relentless drive.

Early Beginnings and Entrepreneurial Spirit

Ajao’s entrepreneurial journey began in Madrid, where he co-founded Tuenti, often referred to as the “Spanish Facebook,” while still a college student. Despite the challenges of balancing academics with entrepreneurship, Ajao’s vision for Tuenti was clear: to create a social networking platform that could rival the likes of MySpace and Friendster. The venture was a resounding success, culminating in its acquisition by Telefonica for $100 million in 2010. His time at Stanford’s Graduate School of Business further honed his entrepreneurial skills. There, Ajao co-founded Identified, a data analytics company for recruiters, which was later acquired by Workday. This acquisition marked Ajao’s second successful exit and set the stage for his venture capital career.

Base10 Partners: A New Paradigm in Venture Capital

In 2017, Ajao co-founded Base10 Partners with TJ Nahigian, establishing a firm that prioritizes both purpose and profit. Base10’s investment strategy focuses on automating sectors of the real economy, such as transportation, healthcare, and logistics. The firm’s Advancement Initiative, a $250 million growth-stage fund, commits half of its profits to scholarships for underrepresented students at Historically Black Colleges and Universities (HBCUs), reflecting Ajao’s commitment to diversity and inclusion. Base10’s portfolio includes high-profile companies like Figma, Nubank, and Rappi, showcasing Ajao’s ability to identify and invest in transformative startups. His investment in Nubank, a digital bank that went public with a market cap of around $30 billion, underscores his knack for backing industry disruptors.

Championing Diversity and Inclusion

Ajao’s influence extends beyond venture capital. He is actively involved in initiatives that promote diversity and inclusion within the tech industry. Through partnerships with organizations like Code2040, the Black Venture Capital Consortium, and CodePath, Ajao is working to create opportunities for underrepresented groups in technology. His efforts have not gone unnoticed. Ajao made history as the first Black investor to be featured on the Midas List of the world’s top venture capitalists, highlighting his impact and success in the field.

A Vision for Africa and Beyond

Ajao’s vision is not limited to Silicon Valley. He sees immense potential in Africa and is committed to leveraging technology to drive economic empowerment across the continent. By investing in startups that address Africa’s unique challenges, Ajao aims to transform these challenges into opportunities for growth and innovation. Reflecting on his journey, Ajao remains focused on the future: “There are a lot of challenges in Africa and with that, a lot of opportunities to also create value and economic empowerment,” he says. His work with Base10 Partners and beyond continues to inspire entrepreneurs and investors alike, demonstrating the power of combining purpose with profit to create lasting impact.

Adeyemi Ajao’s story is one of ingenuity, resilience, and vision. As he continues to break barriers and redefine the venture capital landscape, Ajao remains a beacon of inspiration for Africans and entrepreneurs worldwide, proving that with determination and innovation, anything is possible.