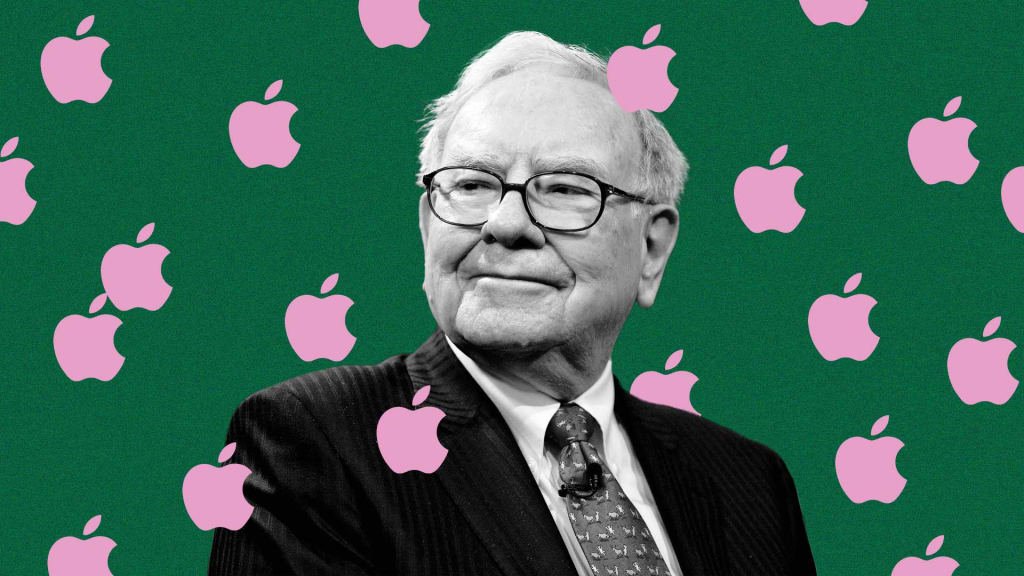

The financial world was startled when Warren Buffett’s Berkshire Hathaway announced a substantial reduction in its Apple stake, a move reflective of shifting strategies within one of the most closely watched investment portfolios. According to Berkshire Hathaway’s recent earnings filing, the valuation of its Apple holdings dropped dramatically from $174.3 billion at the end of 2023 to $84.2 billion by the close of the second quarter in 2024. This significant sell-off marks one of the most notable quarterly reductions in recent memory, signaling a potential reallocation of capital or recalibration of investment priorities.

Warren Buffett, renowned for his long-term investment approach, had significantly increased Berkshire’s exposure to Apple over past years, making it one of the firm’s largest and most lucrative holdings. The sudden pivot, therefore, has garnered widespread attention. To contextualize the magnitude of this sale, it is critical to compare it with previous adjustments. Historically, Berkshire’s adjustments to their Apple position have been much more modest, underlining the exceptional nature of this recent reduction.

Overview of the Significant Sell-Off

This decision comes at a time when Apple has been facing a myriad of market pressures. Reports of supply chain constraints, fluctuating consumer demand, and growing competition have all contributed to increased volatility in Apple’s stock performance. Moreover, a broader trend of tech stock revaluations amid global economic uncertainties might have been factored into Berkshire Hathaway’s decision-making process.

Buffett’s strategic move also aligns with a discernible pattern in his overarching investment philosophy, which often involves recalibrating the firm’s portfolio in response to broader market trends and future growth prospects. While such significant sell-offs are not commonplace, they reflect a deliberate consideration of market conditions and potential opportunities elsewhere. As news of this landmark decision continues to circulate, it sharply contrasts the typically incremental approach that has characterized Buffett’s investment maneuvers, making it a focal point for analysts and investors alike.

Potential Motivations Behind Buffett’s Decision

When Warren Buffett’s Berkshire Hathaway significantly reduces its holdings in a major stock like Apple, it inevitably prompts a thorough analysis of the underlying motivations. One of the primary factors could be portfolio rebalancing. As Apple’s stock price has surged over recent years, it may have represented an increasingly outsized portion of Berkshire’s portfolio. To maintain a balanced investment strategy, Berkshire could be redistributing funds to diversify risk and capitalize on other market opportunities.

Tax considerations also often play a crucial role in such decisions. It has been previously noted that a smaller 13% reduction in Berkshire’s Apple stake was partly due to these considerations. Strategic selling in higher valuation periods can result in considerable tax advantages, especially when these decisions align with fiscal year-end planning or anticipated policy changes. This could help Berkshire optimize its tax position while freeing up capital for future investments.

Concerns over stock valuations might have also motivated this move. Apple’s high valuations, while indicative of strong performance, can signal to seasoned investors like Buffett that a correction might be overdue. Selling at peak prices ensures that Berkshire takes profits at opportune moments, rather than risking potential future declines. Buffett has historically emphasized the importance of value investing, and trimming holdings when valuations appear stretched aligns with this philosophy.

Broader U.S. economic conditions cannot be discounted either. The economic landscape, marked by fluctuating interest rates, inflation concerns, and geopolitical tensions, can make even robust stocks like Apple seem volatile in the long term. By reducing exposure to a single high-value stock, Berkshire might be hedging against macroeconomic uncertainties, ensuring long-term stability for its diversified portfolio.

Collectively, these factors highlight the meticulous and strategic approach that Warren Buffett is known for. The decision to significantly cut the Apple stake reflects a combination of foresighted portfolio management, tax strategy planning, valuation assessments, and economic prudence.

The announcement that Warren Buffett’s Berkshire Hathaway had significantly reduced its stake in Apple sent immediate shockwaves through the market. Investors reacted swiftly, driving Apple’s stock price down by around 5% shortly after the news broke. This notable decline in Apple’s value had a pronounced ripple effect, influencing not only other major technology stocks but also broader market indices. Given Apple’s considerable influence as a leading tech giant, the reduction in Berkshire Hathaway’s holdings was perceived as a signal of potential vulnerability within the technology sector.

The impact extended beyond just Apple, as key indices such as the NASDAQ and the S&P 500 experienced noticeable declines. Companies like Amazon, Microsoft, and Alphabet also saw their stock prices dip in response to the broader apprehension. This correlation underlines the interconnectedness of tech stocks, where significant moves by large institutional investors can create waves across the board. The market’s reaction was colored by underlying concerns of an impending economic downturn, fears that were exacerbated by Buffett’s strategic decision to sell a portion of his Apple holdings.

Market sentiment often shapes investor behavior, and the sale of Apple shares by Berkshire Hathaway was no exception. The move added to existing worries about inflation, interest rates, and overall economic health, amplifying a sense of unease. Investors interpreted Buffett’s actions as a cautious stance towards future economic conditions, prompting them to re-evaluate their positions not only in Apple but within the tech sector as a whole. This scenario underscores the profound influence that prominent investment figures like Warren Buffett have on market sentiment and the consequential shifts in stock market dynamics.

In light of Warren Buffett’s longstanding reputation and the significant weight of Berkshire Hathaway in the investment community, the decision to reduce Apple holdings was scrutinized closely. It raised questions about the long-term growth prospects of tech stocks, and by extension, the stability of the current market. The immediate aftermath illuminated the fragile balance within the market ecosystem where strategic moves by influential entities can trigger widespread reassessment among investors.

Future Outlook: Buffett’s Strategy and Apple’s Prospects

The recent reduction in Warren Buffett’s stake in Apple by Berkshire Hathaway has certainly garnered considerable attention in financial news, prompting questions about future investment strategies and portfolio management. Despite the noteworthy decrease, Apple remains the largest stock position in Berkshire’s portfolio, underscoring its continued importance.

One of Warren Buffett’s core investment principles is to invest in businesses with robust, long-term potential, and Apple fits this criterion well. Buffett has often expressed his deep-seated confidence in Apple’s business model, its management, and its ability to innovate. The decision to reduce the stake likely reflects a strategic recalibration rather than a lack of faith in Apple’s future.

From a portfolio management perspective, Buffett has historically balanced Berkshire’s holdings by occasionally trimming positions in even its most successful investments. This approach ensures a diversified portfolio and reduces overexposure to any single stock, thereby mitigating risk. By reallocating resources, Buffett can capitalize on other opportunities, either within the tech sector or in different industries altogether.

In terms of Apple’s prospects, the company continues to demonstrate strong financial health and innovative prowess. Apple’s advancements in artificial intelligence (AI) signify an exciting frontier that could drive future growth. By integrating AI more deeply into its ecosystem of products and services, Apple aims to enhance user experience and drive further revenue streams. This aligns with broader market conditions where technology and AI advancements play a pivotal role. Apple’s commitment to innovation thus supports Buffett’s investment philosophy centered on long-term value creation.

Moreover, Apple’s resilience in diverse market environments suggests a stable outlook even amid economic uncertainties. The company’s ability to adapt and thrive amidst changing market conditions bolsters its appeal as a sustained investment. Ultimately, while Berkshire Hathaway’s reduced stake may appear substantial, it is consistent with Buffett’s judicious approach to investment management, reflecting strategic decisions rather than a shift in confidence in Apple’s potential.